In Italy’s annual calendar of payment events, Il Salone dei Pagamenti, is without doubt the biggest and most important. Last week, almost 8,000 attendees, came to Milan to visit this year’s show which is always a great barometer for what is hot in payments. With the SEPA Inst scheme having launched just a few days before the show, it is no surprise that this year Instant Payments took poll position.

By Dome Scaffidi, ACI Worldwide

This was evidenced by the number of key players who attended the two-hour SEPA Inst session on the second day. The two-hour debate featured the key players in the value chain who will be responsible for the success of this new payment service that will impact the way banks operate in the future.

Gianfranco Torriero, the ABI Vice General Director, said: “Italy’s banks are becoming more and more like platforms for electronic services, with their key role being to offer innovative payments, whilst focusing on security.” In other words, Italian banks are committed to being at the forefront of Instant Payments implementation.

Jose Santamaria, President of the European Payments Council, Hays Littlejohn, CEO of EBA Clearing, and representatives of the two Italian Banks that went live on November 21st and myself, representing ACI, all testified to the huge potential the new era of Instant Payments is offering financial institutions and their customers.

The President of the EPC delivered a very clear and straightforward message: “We have launched the Pan-EU scheme, now it is up to you in the audience and beyond to take advantage of it and make it work.”

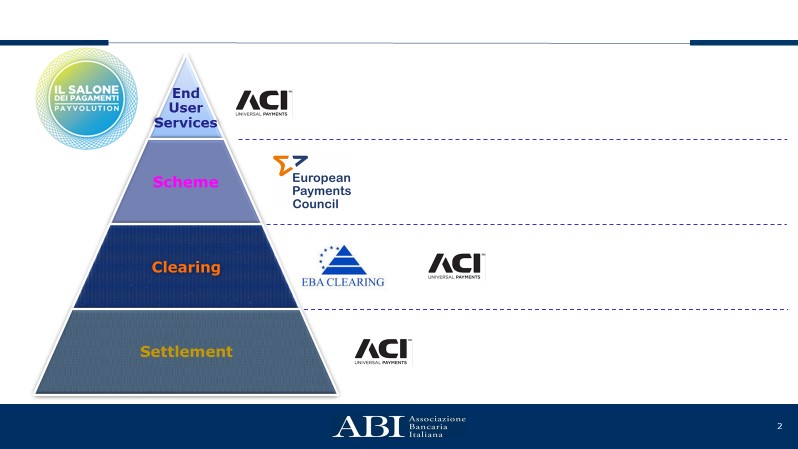

I had the chance to discuss how ACI Worldwide is supporting the payments industry in the settlement, clearing and end user service layers.

Hays Littlejohn highlighted the positive results generated during the first two days of RT1 live – 1005 transactions worth one million Euro per day were made. Ten percent of these transactions occurred between midnight and 6am, outside the normal transaction window, and were therefore only possible through Instant Payment’s 24/7/365 remit. He also predicted that transactions are likely to increase tenfold in the next 5 to 10 years, based on the forecast of 50 banks going live by June 2018 and 90 banks by November next year. He also made clear that the most important challenge for SEPA Inst is that banks cooperate to service the 500 million people who could benefit from Instant Payments and it is this potential reach that makes the SEPA Inst scheme so special.

Rita Camporeale highlighted how ABI, EPC, EBACL, a number of financial institutions and service providers including ACI Worldwide contribute to the success of the entire IP chain, and how all these players had been and will continue to be fundamental to the success of the service.

There was a great consensus among the audience in regards to the two key points that ACI brought to the panel. The first topic I raised was that Instant Payments is never just an IT decision. In order to make Instant Payments a success a business case is crucial. Today, it is evident that too many banks are approaching Instant Payments as simply a new payment typology. This is a very big mistake as Instant Payment, due to its nature, requires a new organizational, and business model, a new vision and understanding of IP being a vehicle for adding extra revenue, a new way to engage and nurture merchants, SMEs, private citizens by meeting customer demand for real-time and finally, a way of tackling the evolving segmentation in the payments market.

The second issue I discussed is that most of the time 24/7 Cash Management in relation to Instant Payments is not being evaluated and considered. Banks often underestimate the LQ management consequences of having legacy infrastructure. Instant Payments is 24/7/365 and therefore, if a bank is only able to fund/defund the settlement account during business hours, then there is the risk that it won’t have enough liquidity to settle payments out of hours such as during the night, bank holidays or week-ends.

At ACI, we are investing in research that supports our clients’ understanding of customer and regulatory demands. This year we conducted a global survey in conjunction with YouGov which revealed that large numbers of SMEs and consumers that are ready to switch bank accounts for the offer of real-time payments.(1)

One final observation: At the end of the panel several bank representatives approached me and said that it was the first time they had heard from a vendor that wasn’t just selling an Instant Payments solution, but also looking to partner in order to help build the business case and understand how Instant Payments can transform the way their bank retains and wins customers. At ACI we strongly believe that our job is to support PSPs before, during and after implementation of Instant Payments by using our global knowledge, and expertise gathered from working on similar projects in the UK, US, Europe, Singapore and Malaysia. Developing competitive business models and inspiring ways to maximise the benefits of Instant Payments is what we do as part of our tailored Universal Instant Payments (UP IP) solution.

(1) All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 9,000 adults. Fieldwork was undertaken between May 31st - June 5th, 2017. The survey was carried out online. The figures have been weighted and are representative of European adults & SMEs in each country (aged 18+).